Whether you’d ask a bitcoin-fan or a critic, most of them will agree that the occurrence of bitcoin is one of the most fascinating events the financial markets have seen in the 21th century. In this blog we will tell you more about what bitcoin is exactly, where this phenomenon suddenly came from and what the future might hold for bitcoin.

The creation of Bitcoin

Ever since the ninetees, scientists and other enthusiasts have been busy trying to create a form of digital currency. They foresaw the fact that the digital world would become more and more prevalent in our everyday lives. For various reasons however, none of these projects ever succeeded.

In 2008 however… no one could have imagined that the next project would be so successful. That was the year Satoshi Nakamoto (a pseudonym of one or more person(s)) published his first concept about bitcoin, the bitcoin whitepaper. In this document he describes his view on a new monetary system. This monetary system should be digital and have a finite supply, the bitcoin protocol stated that only a maximum of 21 million bitcoins would ever be ‘created’.

Furthermore, the protocol would ensure that no third party would be needed when making a transaction. E.g. needing the bank while paying for your groceries at the store. These decentralized features are what made bitcoin truly unique. All transactions are monitored and approved by computers all around the world. This way, the protocol aims to avoid the risk of one party getting too much control over the network and perish the decentralized nature of bitcoin. Important to know; Satoshi visioned bitcoin to be an opposing force against the extremely centralized monetary system and the limitless creation of money.

The technique (blockchain)

Frequently, bitcoin is stated to be the beginning of blockchain technology, that is false. However, bitcoin does use blockchain technology. Blockchain technology ensures for instance that transactions are irreversible in the bitcoin protocol. Put simply, if someone, even Satoshi himself, makes a transaction: this can never be undone. This feature is achieved by nodes monitoring and approving all transactions on the bitcoin network. A node in this case means: a computer that is connected to the bitcoin network to provide computational power (the power to make calculations). Besides monitoring the transactions, they also have to be completed naturally. This also requires an amount of computational power.

Mining

As stated above, when someone wants to make a bitcoin transaction, it has to be carried out by computers. This means the people who own these computers have to be compensated. Besides the investment to buy the computer, the operator of the computer also deals with energy costs and maintenance of the machine. This is where mining comes into play. All transactions are sent to a central hub, the mempool. The operator of the computer, from here on out referred to as the ‘miner’ competes with other miners to be the first to solve the transaction. Think of it as a large group of people racing to be the first to solve an equation, and the winner gets to execute the transaction. For completing the transaction, the miner gets compensated in bitcoin. A new bitcoin has been mined!

One of the exceptional aspects of bitcoin is the self regulating character of the competition in mining. If the price of bitcoin is relatively high, a lot of people will want to mine, and the competition will get harder. But imagine there aren’t that many people interested in mining, because of high energy cost for instance; the protocol will automatically adjust by making the competition easier. Which in its turn attracts new miners. This system has worked flawlessly to this day, even in times of extreme price swings.

Bitcoin and privacy

There is a lot of criticism on bitcoin because of the link between bitcoins privacy and criminal activity. While that’s a fair point, the criticism doesn’t often cover the whole story. Like mentioned before, bitcoin is not supervised or owned by a centralized authority. Therefore, criminals are indeed able to send transactions without interference. However, bitcoin’s privacy is fairly limited. Bitcoin is an open journal, each transaction is visible to anyone. Each time someone registers a new wallet, this wallet can be tracked very easily. With modern day investigation technologies, identifying and mapping suspicious wallets shouldn’t be a problem.

Bitcoin as a form of payment

The initial thought behind bitcoin seemed to be to create a new form of payment. Available worldwide and open to anyone. Only time will tell if this will really be its use case. The first argument against this use case was the limit on the amount of transactions the network was able to process. This was fairly easy to solve by the way. In particular with the use of the lightning network, a secondary layer on top of the bitcoin network that makes transactions on the bitcoin network ultra fast and affordable.

While this definitely makes daily transactions in bitcoin possible, this use case will vary heavily between regions. In Europe for instance, the ‘traditional’ payment system works like a charm. This means there is no real reason to use bitcoin as a form of payment, unless people might dislike banks or governments regulating their funds. In other parts of the world, where the payment system is less advanced or trustworthy, bitcoin might offer some great solutions. For example in rural areas where people have access to the internet, but where they have to rely on cash payments primarily. ‘Banking the unbanked’ will remain an important topic in the adoption of bitcoin, or crypto in general.

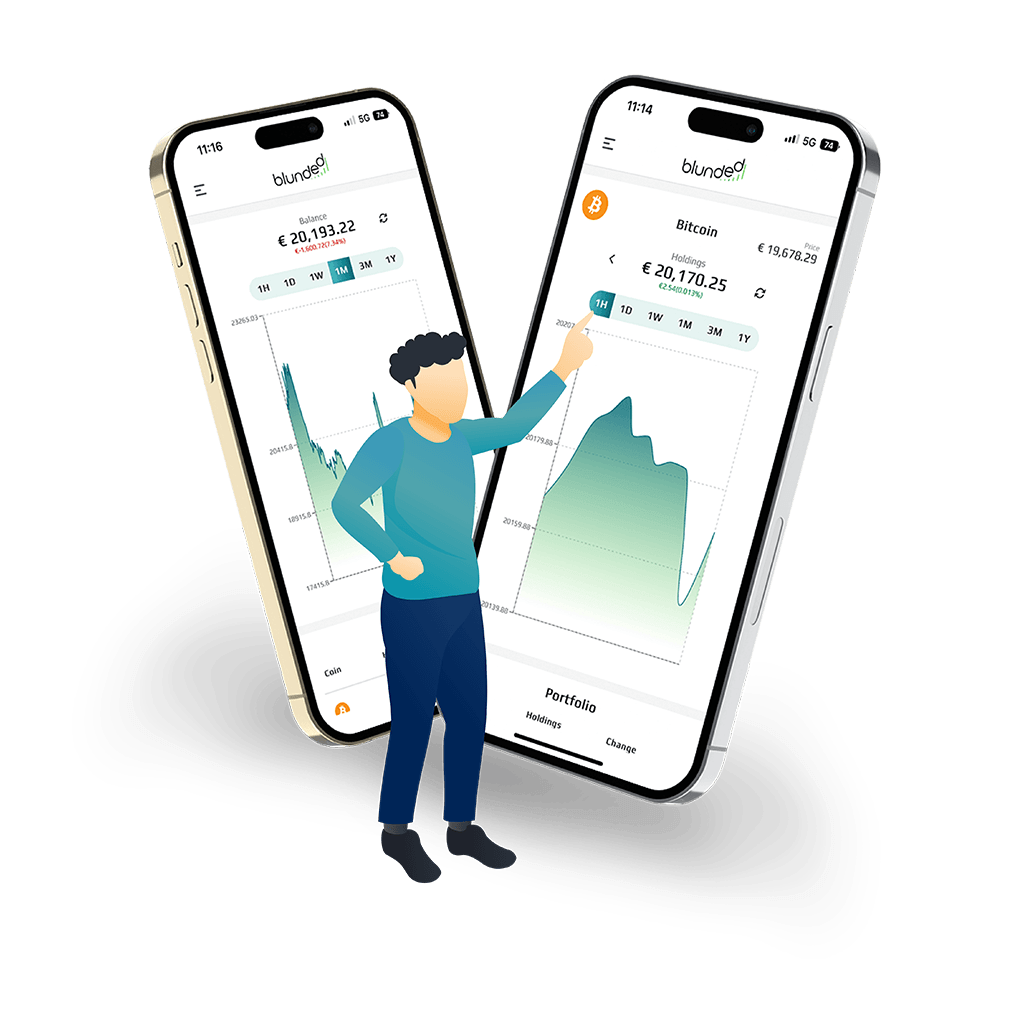

Bitcoin as an investment

What if bitcoin is not going to be used as a form of payment? Wouldn’t that make it kind of useless? Well not regarding the ever growing bitcoin community. They feel, through the years, bitcoin has evolved into an alternative investment that offers a store of value. Similar to gold for instance. Besides the store of value however, gold has a lot of different real world uses. But in comparison to bitcoin, it is harder to trade and to make international payments with.

Up until 2021 we’ve gotten used to declining interest rates, which means borrowing money was getting increasingly cheaper for consumers and businesses alike. This means more and more money was getting into rotation. This was the ‘perfect storm’, the perfect environment, for the adoption of bitcoin and one of the propositions Satoshi used to create bitcoin.

In 2022 the interest rates in Europe and the United States have been inclining rapidly, a new environment for bitcoin to operate in.. Similar to other investments and stocks, this environment didn’t benefit the price up till now. The next 5 years will be very interesting for bitcoin. Which position will bitcoin take in the economical climate, and how will that affect the price?